Dec 16, 2022

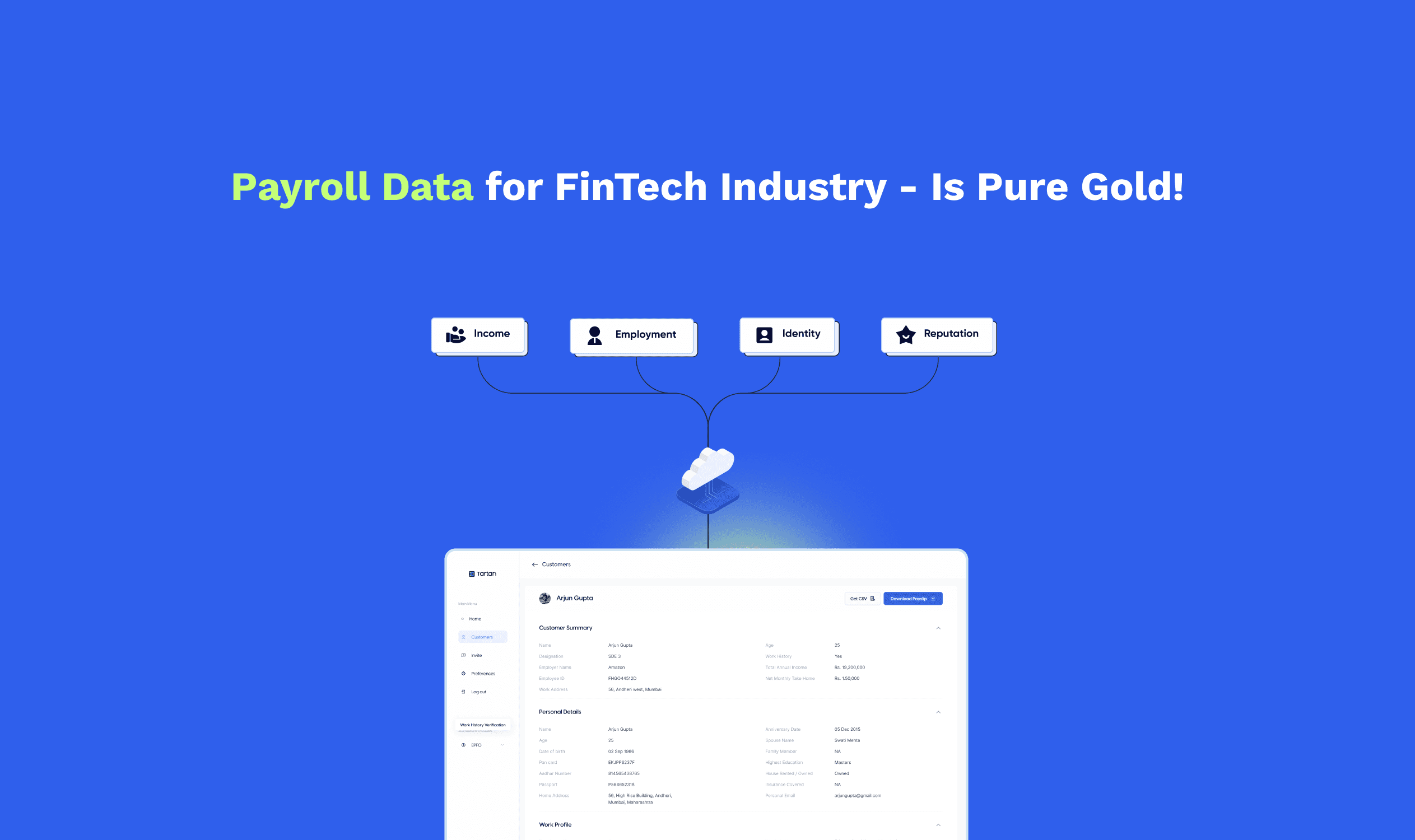

Payroll data for Fintech industry is pure Gold

Introduction

The financial services industry is evolving with new FinTech companies popping up daily. Many of these companies have been able to leverage new data sources to create insight into their customers' financial habits and ideate better products that meet their needs.

Payroll data is one such source of information that has become critical for FinTech companies looking to offer lending products or insurance plans. In this article, we will discuss why payroll data is so useful for FinTech companies and how Tartan enables them by providing real-time access to this information.

What is Payroll Data?

Before we get into what payroll data is and how it can help companies, banks, and Fintech companies, let's first discuss what payroll information is.

Payroll information is the data gathered from payroll systems. This data point gives a complete picture of employment data history, including salary, benefits (such as healthcare coverage or retirement plans), and other types of compensation they receive in exchange for their labor.

Payroll Information – What Can You Learn from It?

Pramey Jain

CEO & Founder