Nov 12, 2024

Protect Yourself from Fake Payslips: Intelligent OCR Makes Fraud Detection Seamless

In today’s digital-first world, businesses in BFSI and Fintech are increasingly adopting automation for customer onboarding and verification. Tartan leads this shift, offering APIs to streamline workflows, including KYC, income verification, KYB, and address verification, helping businesses save time and reduce fraud.

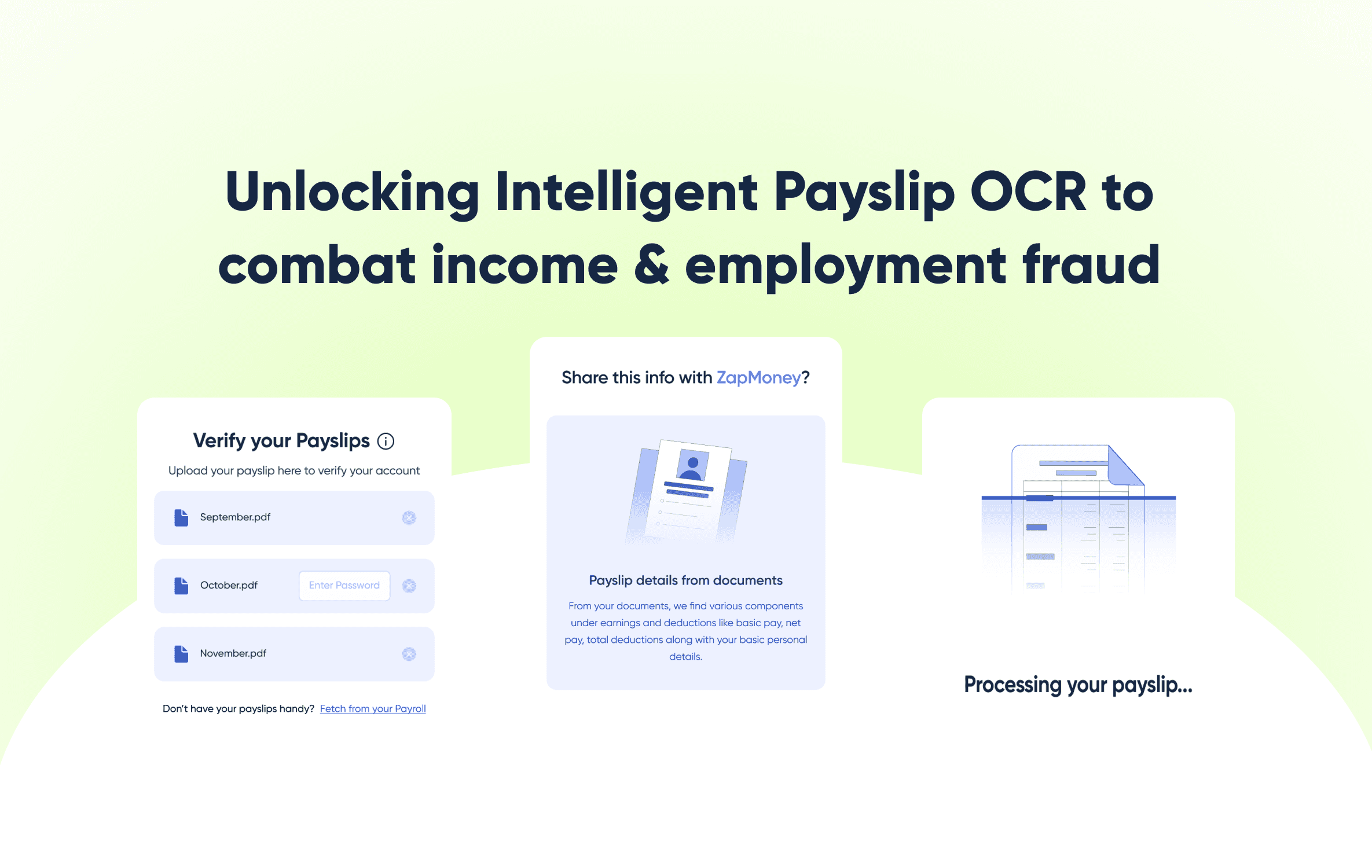

A key solution in our verification suite is the Intelligent Payslip OCR, which automates income and employment verification directly from payslips. This tool is ideal for businesses requiring fast, accurate payslip verification during onboarding or loan approvals.

What is Payslip Verification?

Payslip verification refers to the process of validating the authenticity and accuracy of income and employment data presented in payslips. This is a critical step for financial institutions, lenders, and employers, who rely on accurate data for making important decisions related to credit risk, loan approvals, and hiring. With Tartan’s Intelligent Payslip OCR, the process becomes faster, more accurate, and secure by automating the extraction, validation, and verification of key details from payslips.

Why choose Tartan’s Intelligent Payslip OCR ?

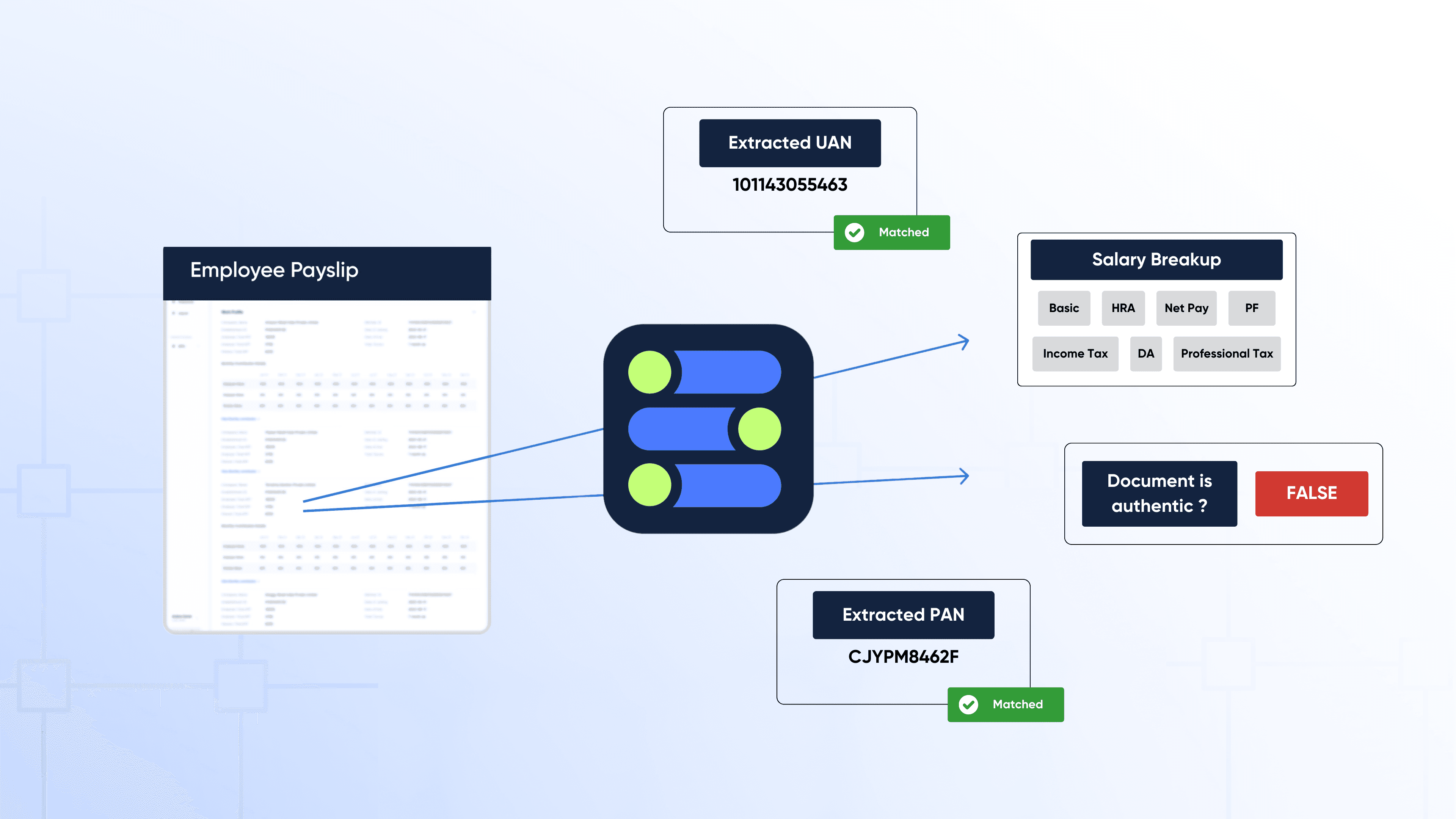

Tartan's Intelligent Payslip OCR, unlike other existing solutions, not only extracts key data points from payslips, but also validates extracted information like UAN, PAN, Employer etc. with government records (EPFO). Extracted data includes:

Employee Details - Name, Designation, Employee ID, linked UAN and PAN, Bank Account

Salary Breakdown - Basic, DA, HRA, Special Allowance, Professional Tax, Income Tax, PF deductions, Paid Days, Net Pay

Employer Details - Name, Address, Employee Date of Joining

The system is trained on more than a million payslips (specifically Indian standard payslips), allowing it to accurately read and process a wide variety of payslip formats. After extracting the data, the API cross-references it with government records, such as the EPFO database, to validate its authenticity. The API can also detect signs of manipulated or falsified payslips, helping businesses avoid costly fraud.

Who Can Benefit from Payslip Verification?

The Intelligent Payslip OCR is particularly useful for businesses in the lending, banking, and employee verification sectors. Here’s how each of these sectors can benefit:

Lending: Lenders can use the API to verify the income details presented in payslips. Accurate payslip verification helps financial institutions assess creditworthiness, minimise fraud, and make informed lending decisions. Since unsecured loans for new-to-credit (NTC) users has always been a challenge, income and employment information acts as a suitable proxy to approve such applications. By automating this verification process, lenders can also significantly reduce the turnaround time for loan applications.

Banking: Financial institutions can leverage the extracted payslip data to verify the income of prospective customers when they open new accounts. This verification ensures that banks offer tailored financial products—such as loans and credit cards—based on verified income information.

Employee Background Verification: Employers can integrate this API to verify the income and employment details provided by job applicants. This helps reduce the risk of hiring candidates who may have falsified their employment history or salary claims.

Real-World Example: Lending Use Case

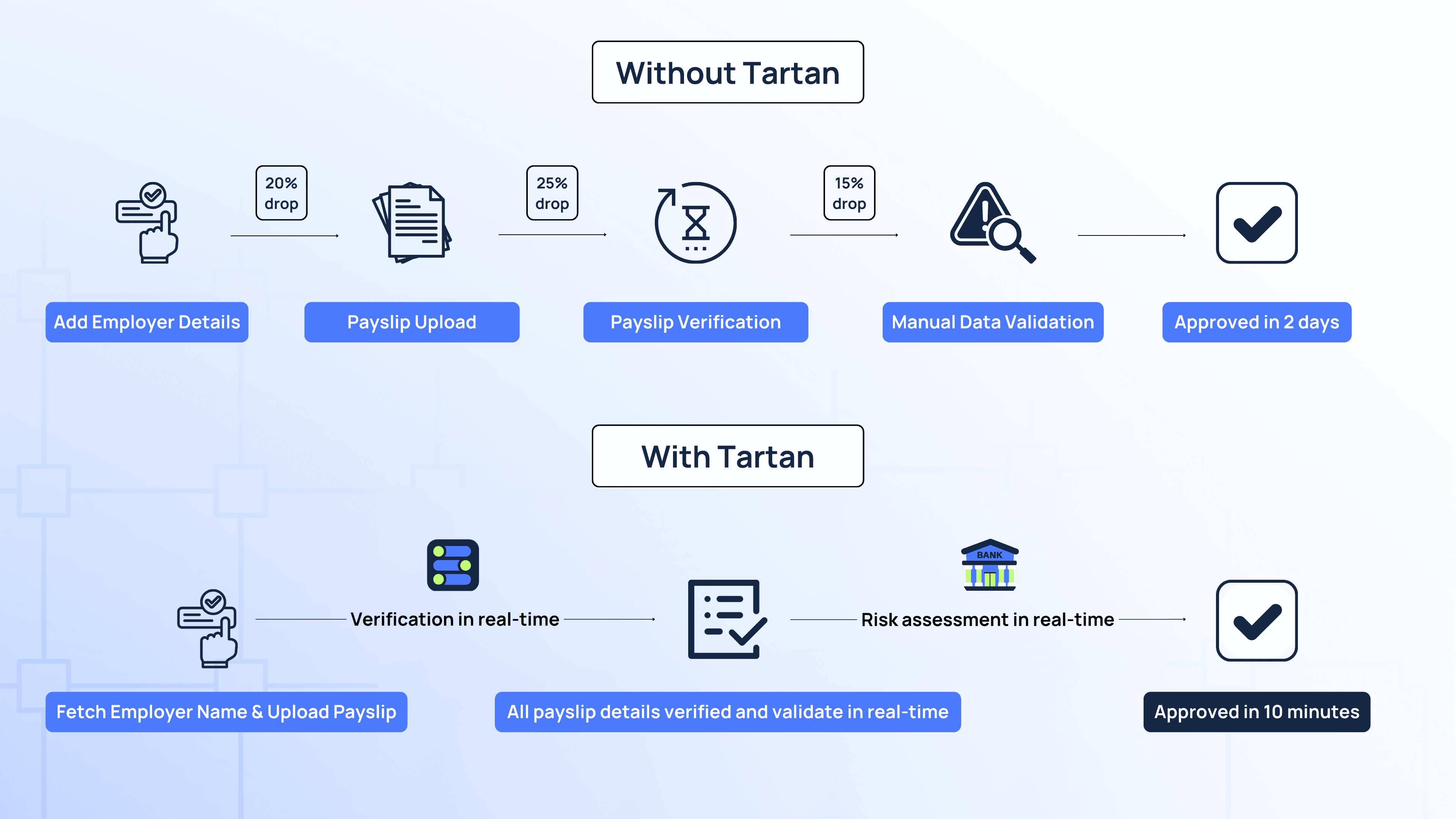

A leading financial institution significantly enhanced its loan application turnaround time (TAT) using Tartan's Intelligent Payslip OCR.

Previously, the institution manually reviewed thousands of loan applications daily, verifying payslips as proof of income. This process was labor-intensive, requiring dedicated resources to authenticate each payslip and validate its details.

By integrating Tartan’s OCR solution, the institution automated payslip verification. The API extracted key details—such as salary, deductions, and employer data—and cross-referenced them with EPFO records. Discrepancies, such as potential manipulation of payslips, were flagged in real-time, enabling the client to avoid fraudulent loan approvals while expediting legitimate applications.

This solution not only saved time but also minimised the risk of approving loans based on falsified information, resulting in more informed decisions and reduced bad debt.

Benefits of using Tartan’s Intelligent Payslip OCR

User Onboarding TAT Reduction (35%): Automates payslip verification, cutting onboarding time by 35%, enabling quicker customer onboarding and faster decision-making.

Manual Re-verification Eliminated: Automatically cross-references UAN and PAN data, removing the need for manual checks, reducing errors and improving efficiency.

Increase in Loan Approvals (20%): Enhanced payslip verification boosts loan approval rates for New-to-Credit (NTC) users by 20%, increasing access to credit.

Conclusion

In the modern financial ecosystem, income and employment verification is a crucial part of ensuring that new-to-credit users are also able to reap benefits of increased financial penetration. Tartan’s Intelligent Payslip OCR streamlines this process, by offering lenders a faster, more reliable way to verify payslips and reduce the risk of fraud.

To have a live demo of our entire verification suite, get in touch with us for a short call and see how we work towards eliminating identity fraud in digital systems.

Pramey Jain

CEO & Founder