Aug 30, 2024

Tartan's Verification Product Update - August '24

Know Your Business (KYB) is essential in India as regulatory frameworks tighten and businesses seek to mitigate risks. By verifying the identity and legitimacy of partners, companies can enhance compliance, prevent fraud, and ensure a secure operating environment, fostering trust and transparency in an increasingly complex marketplace. In Tartan's product update, this month we are talking about a couple of unique solutions to address the same.

We’ve launched a new Employer Check API, designed to streamline the verification process for businesses. This API allows users to input a company name, selecting from multiple options to ensure accuracy. Once a company is selected, the API returns comprehensive establishment details and status as per Form 5A and the EPFO master database.

Key Use Cases:

(i) Vendor Onboarding: Simplify the vetting process for new vendors by quickly verifying their establishment status, ensuring compliance and reducing risks.

(ii) Know Your Business (KYB): Enhance your due diligence efforts by accessing accurate and up-to-date information on potential partners, fostering trust and security in business transactions.

(iii) Business Loans: Financial institutions can utilise the API to assess the legitimacy and operational status of businesses seeking loans, facilitating quicker and more informed lending decisions.

With the Employer Check API, businesses can expect improved efficiency, reduced fraud risk, and streamlined operations, aligning with industry best practices for compliance and verification. This feature positions us to support our clients more effectively in their operational and financial pursuits.

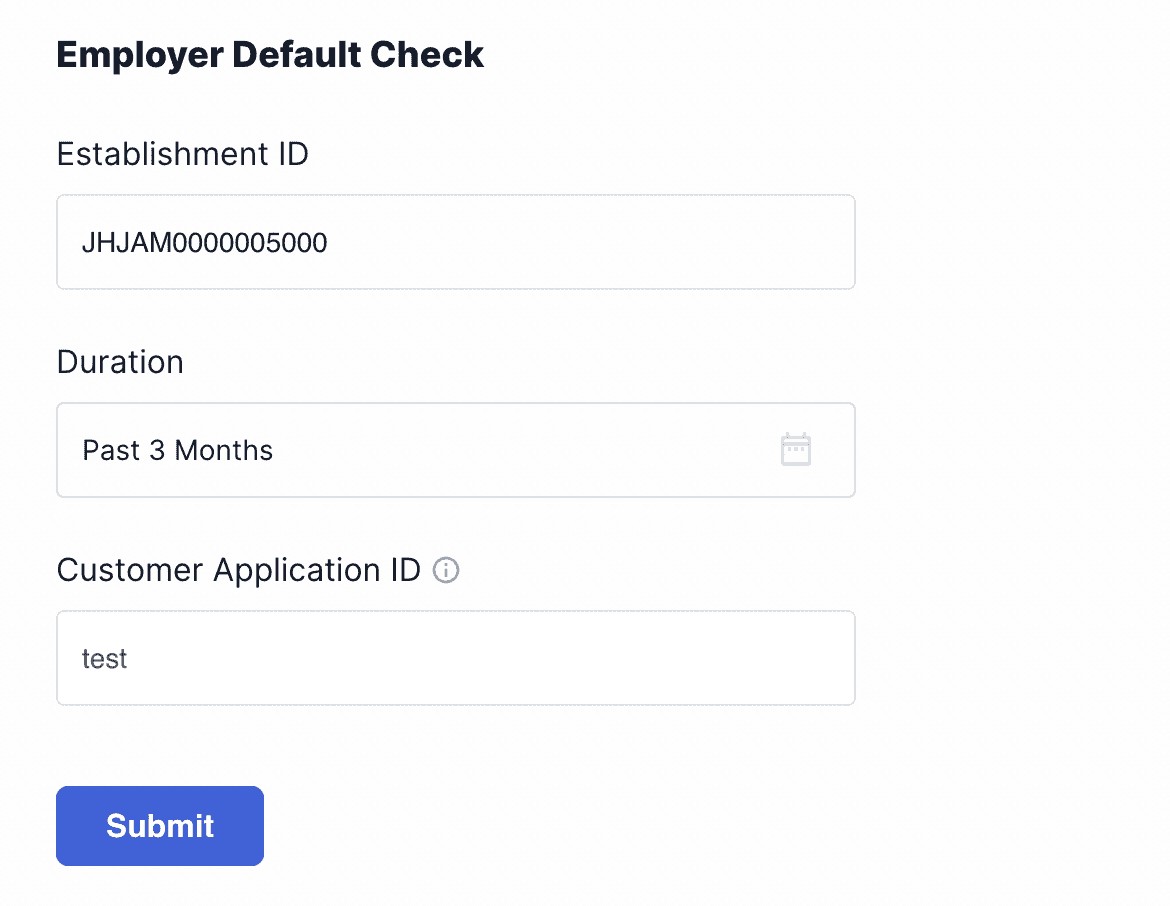

Another solution is an Employer Default Check API, a powerful tool designed to enhance business insights and decision-making. By inputting an Establishment ID from the EPFO database, users can retrieve detailed company information, including historical monthly Provident Fund (PF) transactions and data on members for whom PF was transferred, along with highlighting any delays.

Key Use Cases:

(i) Employee Growth: HR departments can leverage this API to assess a company’s commitment to employee welfare by examining its PF contributions, ultimately aiding in talent acquisition and retention strategies.

(ii) Lending Decisions: Financial institutions can utilise the API to evaluate a business’s financial health and stability. By reviewing past PF transactions and any delays, lenders can make more informed decisions regarding creditworthiness.

(iii) Company Stability: Investors and stakeholders can gain insights into a company’s operational stability. Consistent PF contributions reflect a company’s reliability and potential for sustainable growth, informing investment strategies.

By integrating the Employer Default Check API, organisations can significantly enhance their analytical capabilities, align with best practices in risk management, and foster a culture of transparency and accountability. This API positions us to support clients in navigating the complexities of employee management and financial decision-making effectively.

To access any of our other solutions related to identity, income or employment verification, book a demo with our team.

Pramey Jain

CEO & Founder