Nov 1, 2024

Tartan's Verification Product Update - October 2024

In this fast-paced world of digital lending, a new challenge has emerged: new-to-credit users find it increasingly tough to get unsecured loans. With the Reserve Bank of India tightening regulations for Non-Banking Financial Companies (NBFCs), the quest for reliable proxy data became critical. As lenders navigated this tricky landscape, they faced the daunting task of maintaining growth while reducing risks in an ever-competitive market.

But fear not! Tartan is here to transform this narrative. We’re developing groundbreaking solutions that pull in valuable proxy data from multiple sources to validate income source for an individual, going beyond traditional metrics like credit scores and bank statements. Here are some of our innovative offerings:

UAN to Latest Employment: This powerful API digs deep to deliver the most recent employment detail tied to a Unique Account Number (UAN), ensuring accurate tenure calculation via UAN portal.

UAN to Passbook: Now, users can effortlessly retrieve their EPFO passbook linked to their UAN, giving lenders insights into recent employment based on the latest Provident Fund entries.

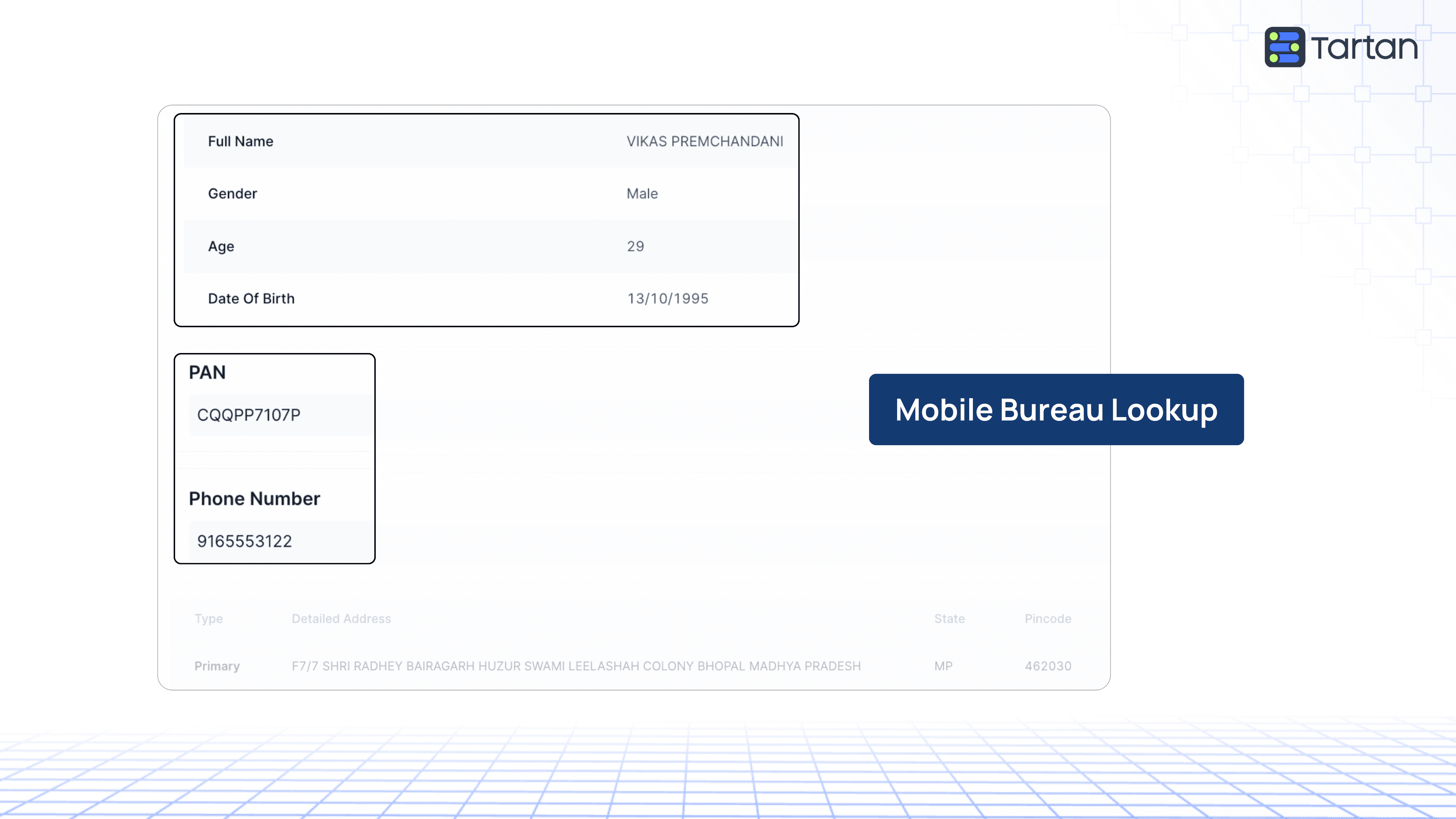

Mobile Bureau Lookup: Unlock a treasure trove of information using just a mobile number! This tool reveals contact details, address history, identification documents, and demographic data, helping lenders paint a clearer picture of potential borrowers.

Meanwhile, the world of MSME lending shines with untapped potential, offering exciting opportunities for NBFCs and fintech players eager to expand their market share. However, the challenge remains: assessing creditworthiness can be a puzzle due to limited reported data on turnover, profits, and business size.

Enter Tartan’s tailored solutions! We’re equipped to validate compliance and risk assessment with essential proxy data, including tax compliance and employee growth. Check out these game-changing solutions:

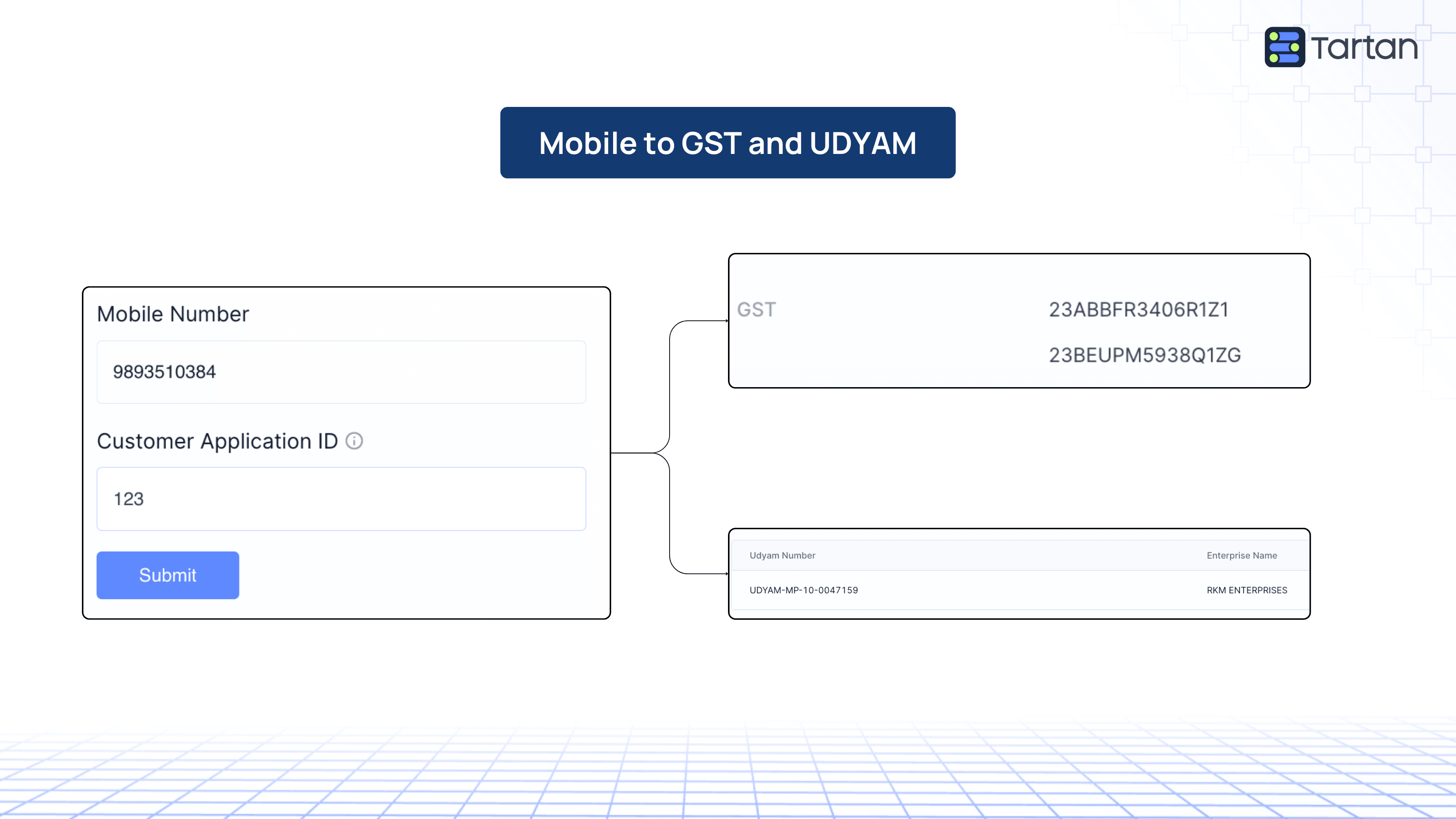

Mobile to GST: This solution connects multiple GST registrations to a mobile number, providing insights into the number of businesses associated with an individual and their compliance status.

Mobile to UDYAM: Validate MSMEs from a compliance perspective with ease! This API reveals all UDYAM numbers tied to an individual, ensuring thorough verification.

TAN Detail: With this comprehensive tool, you can fetch essential company information—like name, phone, email, and address—based on the Tax Deduction and Collection Account Number (TAN), helping to confirm tax compliance.

With Tartan leading the charge, the lending landscape is evolving, paving the way for smarter decisions and increased opportunities for all. Get in touch with us to learn more about our innovations to serve the underserved!

Pramey Jain

CEO & Founder